Updating industries with Digitization and advanced technologies

Our client is a global energy company headquartered in Singapore since 1997. They specialize in producing, distributing, and marketing petroleum products across 5 continents and 40+ countries. Their primary focus is on retail fuel and supplying energy products to industries such as mining, aviation, marine, and construction. With 3,000+ service stations worldwide, the company has invested in renewable energy and implemented sustainability initiatives to reduce its environmental impact. With a workforce of approximately 8,000 employees, customer satisfaction is their top priority.

Businesses must constantly adapt to new technologies and trends if they want to keep up with constantly evolving technology. It should also ensure that its platforms are accessible, flexible, and scalable as per customers’ expectations.

As sensitive data is increasingly stored and transmitted online, security has become a major concern for tech companies. Managing and analyzing the growing volume of data presents additional challenges.

The company needed to ensure that its platform is compliant with all relevant regulations and that it stays up-to-date with any changes. Challenges exist, but staying innovative, focused on customers, & nimble help them thrive.

The KYC process for customers is being digitized using technology to verify identity and collect relevant information. Manual KYC procedures are being replaced by digital solutions for a more efficient and streamlined approach.

Digital KYC solutions use digital tools like biometric identification, online forms, and digital signatures to remotely verify customers’ identity and collect relevant information. Technologies like facial recognition, document scanning, and artificial intelligence enable faster processing times and reduce the risk of errors or fraud.

Digital KYC solutions offer several benefits to customers with faster and more convenient identity verification. Businesses benefit from reduced costs, improved efficiency, enhanced security, and compliance with regulatory requirements. It’s an effective approach for risk management and identity verification.

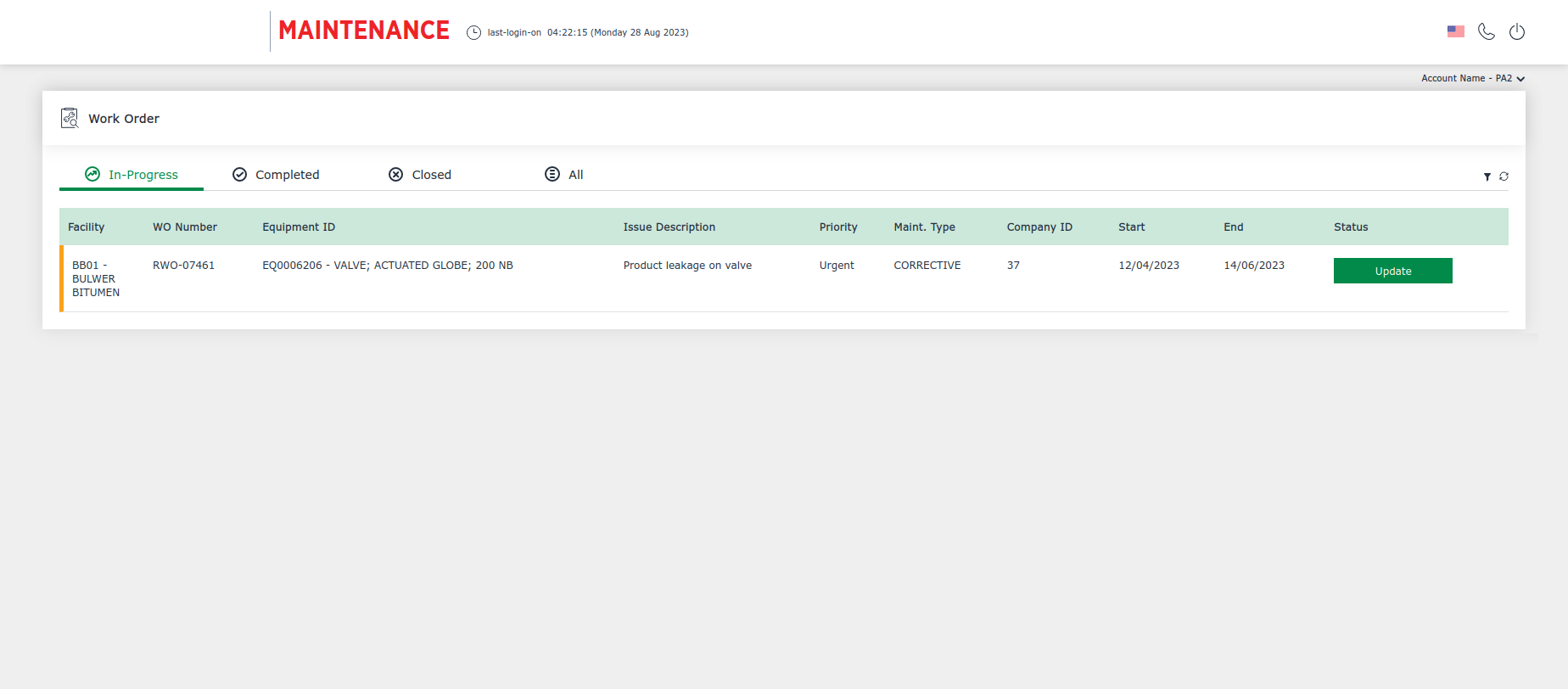

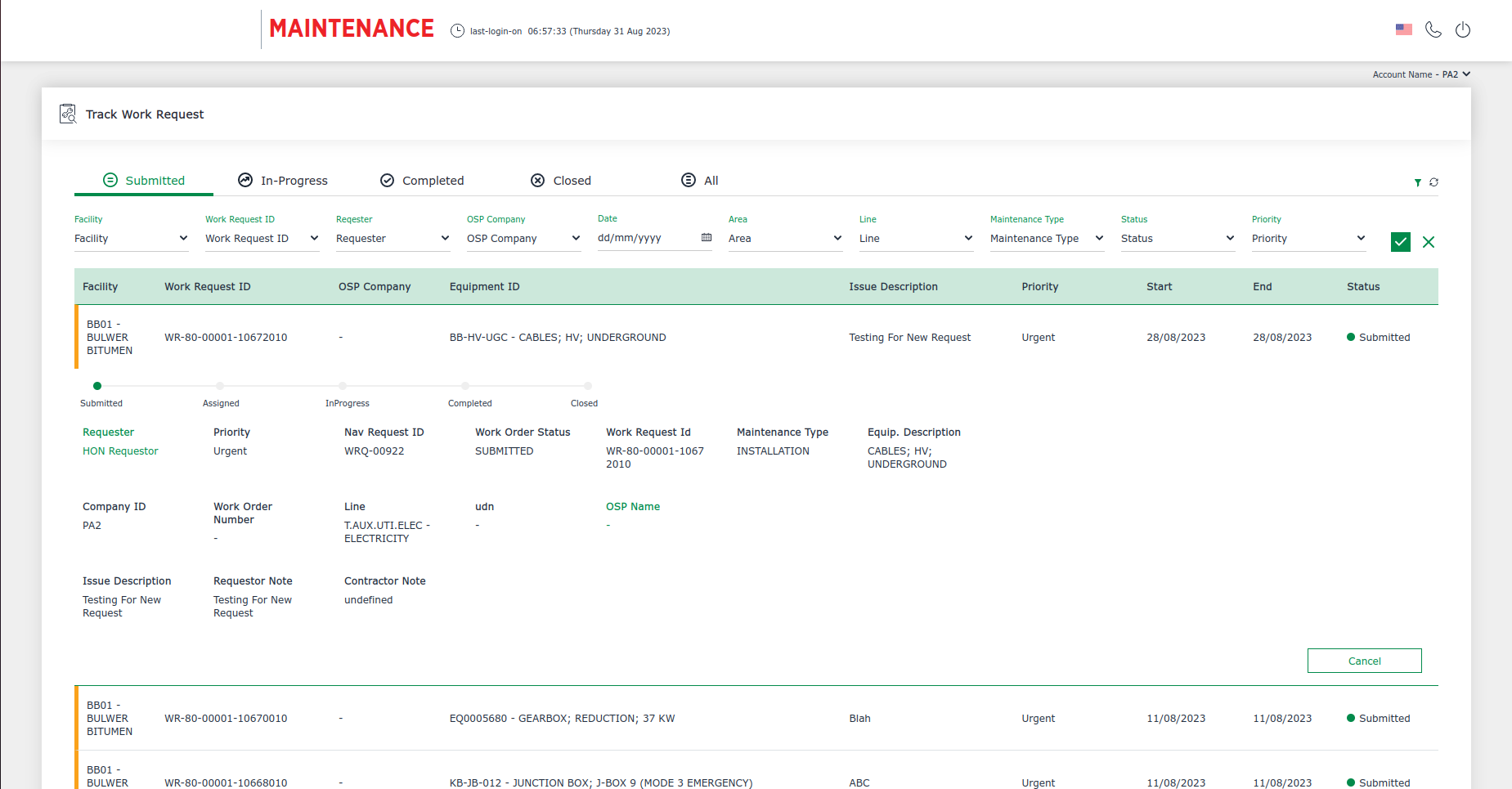

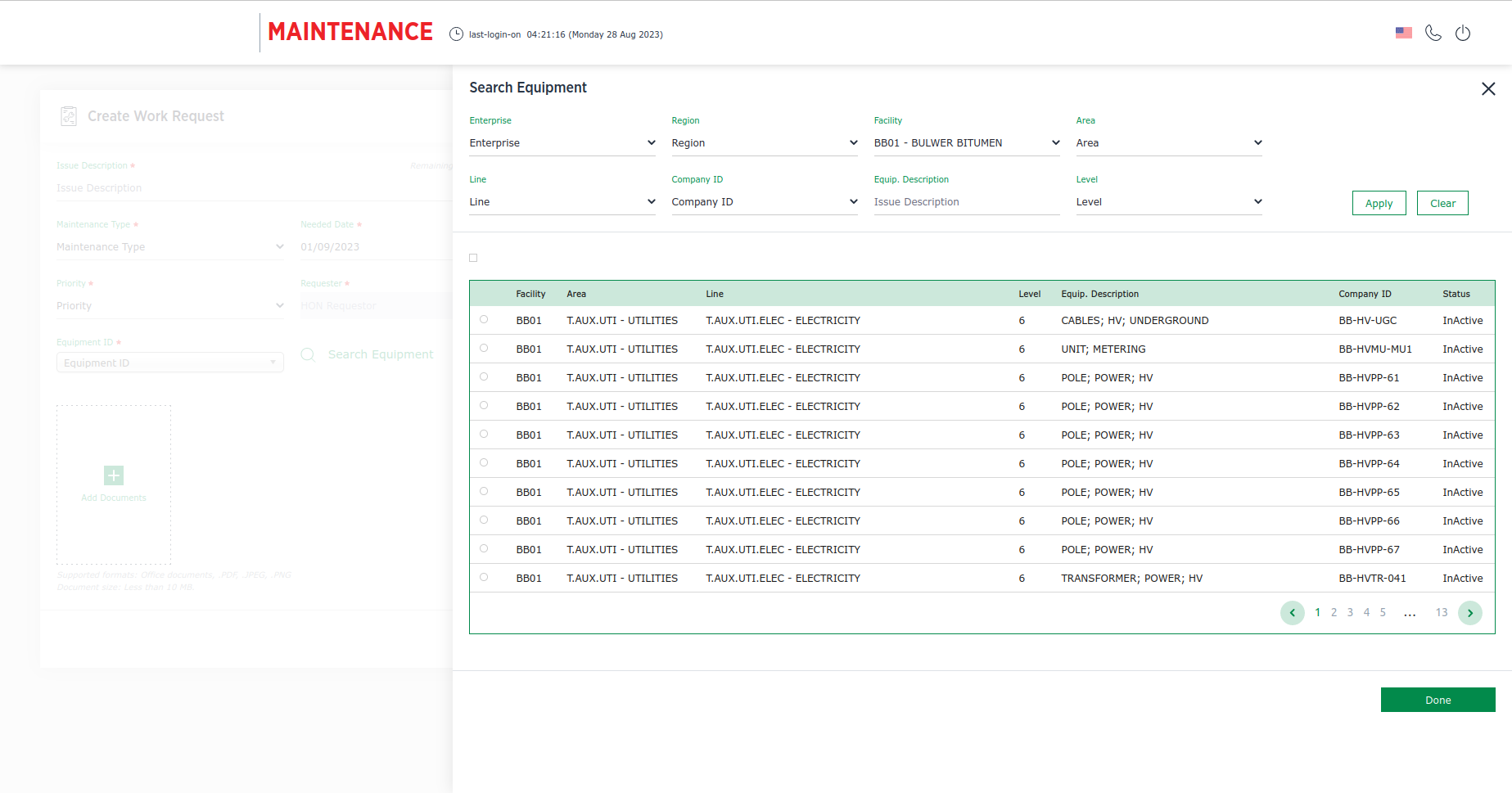

Our esteemed client faced various challenges in the fast-paced and constantly expanding world of information technology. They were finding it hard to keep up with the emerging technologies and fulfill changing customer expectations in terms of security and data, among others. They hired Tridhya Tech, a leading software company that provides a platform for building and deploying enterprise-level websites, portals, and intranets. We addressed these challenges through the digitalization of the customer KYC process. Further, we implemented technologies like DXP 7.3, PostgreSQL, and Azure VMs for a quick solution. Ultimately, by accepting innovation, our esteemed client was able to thrive and will continue to thrive in this ever-changing world of IT.

Azure VM

DXP 7.3

Liferay

PostgreSQL

401, One World West, Nr. Ambli T-Junction 200, S P Ring Road, Bopal, Ahmedabad, Gujarat 380058

Kemp House 160 City Road, London, United Kingdom EC1V 2NX

Nürnberger Str. 46 90579 Langenzenn Deutschland

Level 36 Riparian Plaza, 71 Eagle Street, Brisbane, QLD 4000

4411 Suwanee Dam road, Bld. 300 Ste. 350 Suwanee GA, 30024

Cube Work Space, 24 Hans Strijdom Avenue, Cape Town

B 503 Sama Tower, Sheikh Zayed Road, United Arab Emirates

34 Applegrove Ct. Brampton ON L6R 2Y8